Stack Sats

Stay Humble, Stack Sats

"Stay humble, stack sats" is a term used by Matt Odell that summarizes the investment thesis of every Bitcoiner. Staying humble is the art of accepting that we do not know what the price of bitcoin will be in the short term. A "crash" is one China ban or unscrupulous exchange rug-pull away. Those who were rug-pulled think bitcoin is a scam, but the people who understand how the protocol works and take self-custody of their wealth will have an opportunity to stack more sats. Be the latter group, not the former.

In other words, sats flow from those who do not understand bitcoin to those whom understand bitcoin. The bitcoiners who take self custody of their bitcoin are un-ruggable because they hold their own keys. The SBF's of the world cannot gamble away our sats because they do not own our sats.

A common trope among pre-coiners is, "don't invest in things you don't understand." This is good advice, but bitcoin is not an investment. It is money built on a decentralized computer network. It is created by laws of mathematics not government.

📸 study bitcoin.

The purpose of this guide is to teach you how to stack sats without going through a financial institution". History is filled with examples of breaches of trust, monetary debasement and currency death, the result is double-spending.

This is a counter-culture created by bitcoiners who run nodes, mine bitcoin, write code or create bitcoin art like paintings, books, and music. Each bitcoin wallet has an identity, like a fingerprint that cannot be changed. It is binary in a non-binary world, freedom in an unfree world. "Stay Humble, stack sats," is a great tagline. The alliteration is phenomenal, but the way I see it, the goal is to earn sats, spend sats, and save sats.

Take your time. It won't happen over night. There is much to learn. Most people have heard the advice, "don't invest in things you don't understand." This is great advice. If you do not understand bitcoin, you will almost certainly lose money. Some scammer will call you and give a scary story or tell you you they will give you more bitcoin if you deposit some with them first. Some of these are akin to Nigerian prince emails. Other times, famous people on Twitter get hacked and say they will send 2 bitcoin for every one bitcoin you send them. This one time, a company bought ad space on the biggest bitcoin podcast and told everyone they would pay a 7% yield on bitcoin deposits. The most recent heist was pulled off by some vegan pervert who claimed to be an autistic genius and effective altruist. The plain fact is, solving the double spending problem means there is no way to recover your bitcoin if it gets stolen or swindled. You must be vigilant. One whole bitcoin might be worth 10 million dollars in ten years, but if your bitcoin gets stolen or lost, you and your posterity will be unable to spend it.

To protect ourselves, we must:

NEVER GIVE ANYONE YOUR 12 OR 24 WORD SEED PHRASE

REMAIN AS PRIVATE AS POSSIBLE

STAY HUMBLE

Staying humble is not as easy as it sounds, but it is necessary. If you get too over-confident, you might make mistakes. Mistakes can be disastrous. We have all heard stories of people combing through landfills hoping to find laptops worth hundreds of millions of dollars. You don't want to be that guy. The goal of this guide is to teach you how to use bitcoin as it was meant to be used--as peer-to-peer electronic cash.

What Is Bitcoin?

"Writing a description for this thing for general audiences is bloody hard. There's nothing to relate it to."--Satoshi Nakamoto

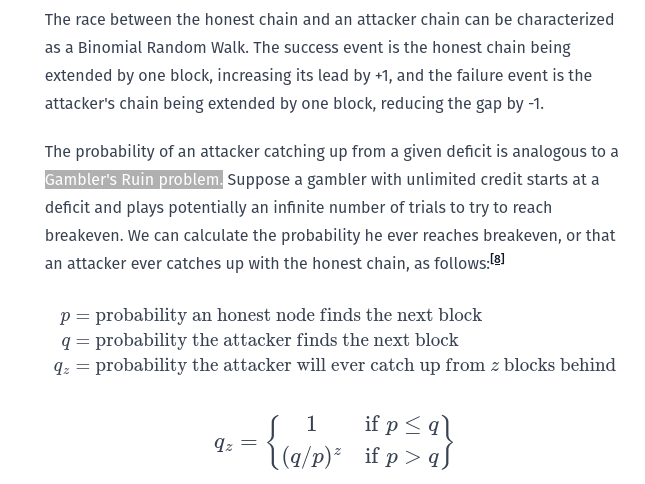

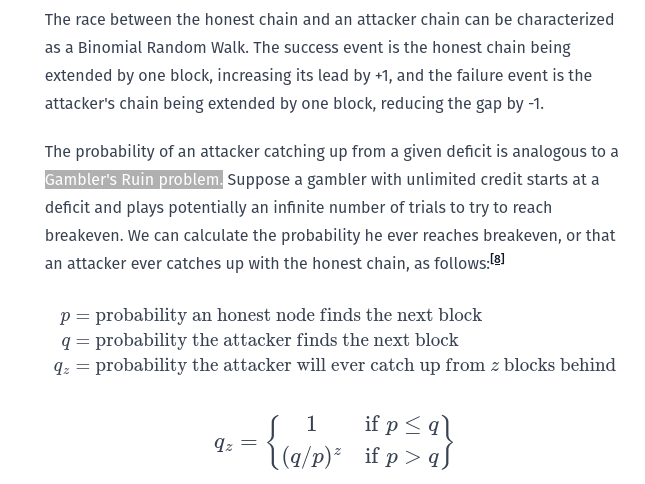

Bitcoin is a peer-to-peer electronic cash system. This is a simple sentence composed of nine words to describe a new monetary system Satoshi explained in nine pages. It contains a lot of math most people don't understand and that's just the calculus. The white paper doesn't have any cryptography because much of the cryptography behind the bitcoin timechain comes from Adam Back's HashCash. Therefore, bitcoin is difficult to explain to a general audience because it is a synthesis of many different components very few people are familiar with. Understanding the intricacies of bitcoin requires background knowledge in distributed computer networking, public key cryptography, Austrian economics, computer science, game theory, calculus, probability, and the history of money.

Most people receive very little( if any) education about these subjects in public school and only a small percentage of college graduates learn anything about these subjects. This makes the bitcoin white paper a work of art very few people can appreciate. I had no idea what most of the White Paper meant when I first read it because I knew almost nothing about these subjects back then. I never heard of cryptography and failed Algebra II in high school and I never took calculus either. I was obsessed with low-stakes, limit hold 'em before studying bitcoin, but that gave me just enough background knowledge to understand this was a serious project.

Satoshi Nakamoto was a brilliant mathematician. He made me realize math is a language like C++ or English. He often translated the code into math, math into code, and code into plain English. In many ways, the bitcoin white paper is like the Rosetta Stone, but one can argue it's historical significance is greater than the Rosetta Stone. This may sound like a bold statement to the uninitiated, but I consider it to be a work of art. I believe anyone with an average IQ can comprehend the bitcoin white paper given enough time, and I encourage you to read it. Then study bitcion more. Read it again. Rinse and repeat.

For the purpose of this guide, however, we will only focus on a the first few sentences.

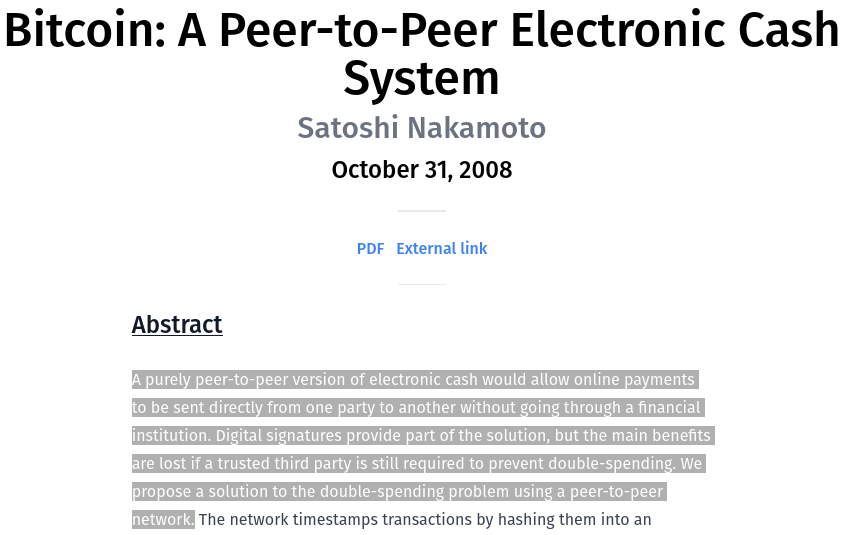

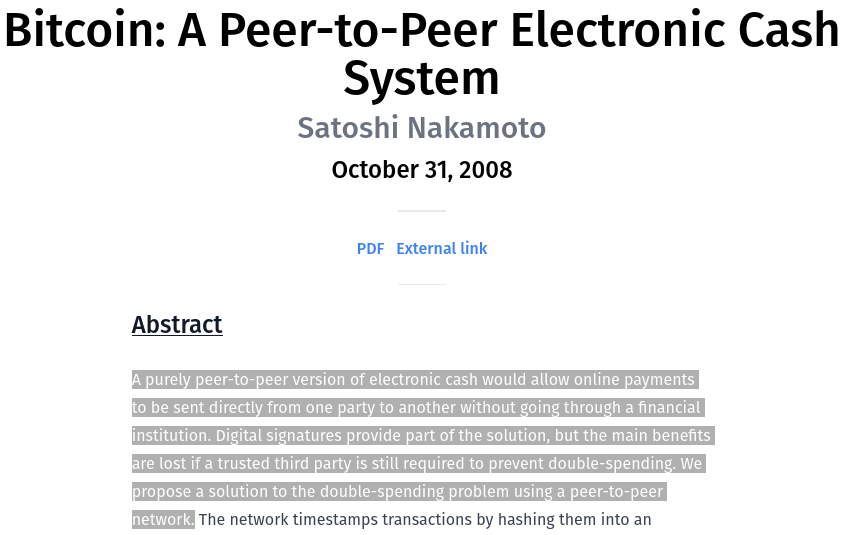

*A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital Signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network.

The purpose of this guide is to teach you how to use bitcoin the way it was meant to be used-- without going through a financial institution.

Explain It To Me Like I'm 5

A decade ago, bitcoin was difficult to learn, but now we have cartoons. This guide aims to make bitcoin easily understandable by anyone with a high school education. If you want to know the gist of why bitcoin is important, watch this three minute clip of the first bitcoin cartoon. You don't need need to learn much about math to use bitcoin if you don't want to. You just need the basic idea behind what the math accomplishes. Here is a three minute explanation from the Tuttle Twins.

This Is Not Financial Advice

Bitcoin is math. This guide is written from the perspective of a dad teaching his kids how to use that math to save bitcoin without going through a financial institution. This is education not financial advice. The point of this guide is to teach you how to stack sats. A million sats is a million sats. I can't predict when a million sats will buy $10,000 and even if I could...Who knows what $10,000 will buy. This guide is bitcoin only and is not concerned with measuring this peer-to-peer electronic system to the money printer go brrrrrr fiat system.

There are no guarantees and it is written with no warranty. If you lose your keys, no one can help you spend your bitcoin. As Satoshi said, it becomes a donation to everyone on the network. Therefore it is important for you to remember the following:

NEVER TYPE YOUR KEYS INTO A COMPUTER CONNECTED TO THE INTERNET

NEVER GIVE YOUR KEYS TO SOMEONE ASKING FOR THEM.

NEVER SEND BITCOIN TO SOMEONE WHO CLAIMS HE WILL GIVE YOU MORE BITCOIN IN RETURN

Financial Institutions Are The Double Spending Problem

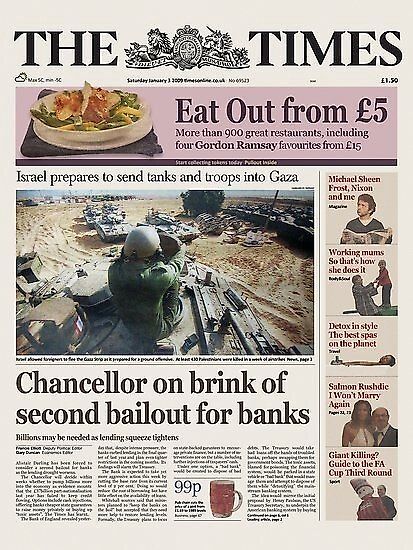

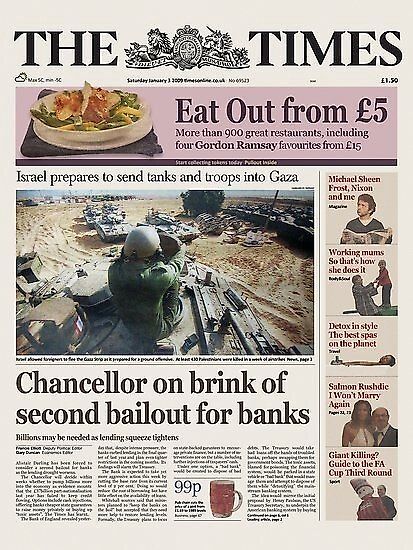

The bitcoin white paper was released on October 31st, 2008. The software went live on January 3rd, 2009. The day the genesis block was born using an obscure branch of mathematics known as cryptography. Crypto means secret and graph means writing. Therefore, cryptography is a type of secret writing that has existed for thousands of years. Satoshi left a secret message in the scriptsig(hex) of this block. I said is not necessary to learn much about math if you want to use bitcoin, but the math in the first block is one exception. To the uninitiated, this is just a random string of letters and numbers, but it is actually a huge insight into why bitcoin is important and what solving the double-spending problem achieves

scriptsig(hex)

04ffff001d0104455468652054696d65732030332f4a616e2f32303039204368616e63656c6c6f72206f6e206272696e6b206f66207365636f6e64206261696c6f757420666f722062616e6b73

Challenge 1

Decrypt the secret message Satoshi left in the genesis block.

Why do you think Satoshi left this message in the bitcoin genesis block?

Stay Humble, Stack Sats

"Stay humble, stack sats" is a term used by Matt Odell that summarizes the investment thesis of every Bitcoiner. Staying humble is the art of accepting that we do not know what the price of bitcoin will be in the short term. A "crash" is one China ban or unscrupulous exchange rug-pull away. Those who were rug-pulled think bitcoin is a scam, but the people who understand how the protocol works and take self-custody of their wealth will have an opportunity to stack more sats. Be the latter group, not the former.

In other words, sats flow from those who do not understand bitcoin to those whom understand bitcoin. The bitcoiners who take self custody of their bitcoin are un-ruggable because they hold their own keys. The SBF's of the world cannot gamble away our sats because they do not own our sats.

A common trope among pre-coiners is, "don't invest in things you don't understand." This is good advice, but bitcoin is not an investment. It is money built on a decentralized computer network. It is created by laws of mathematics not government.

📸 study bitcoin.

The purpose of this guide is to teach you how to stack sats without going through a financial institution". History is filled with examples of breaches of trust, monetary debasement and currency death, the result is double-spending.

This is a counter-culture created by bitcoiners who run nodes, mine bitcoin, write code or create bitcoin art like paintings, books, and music. Each bitcoin wallet has an identity, like a fingerprint that cannot be changed. It is binary in a non-binary world, freedom in an unfree world. "Stay Humble, stack sats," is a great tagline. The alliteration is phenomenal, but the way I see it, the goal is to earn sats, spend sats, and save sats.

Take your time. It won't happen over night. There is much to learn. Most people have heard the advice, "don't invest in things you don't understand." This is great advice. If you do not understand bitcoin, you will almost certainly lose money. Some scammer will call you and give a scary story or tell you you they will give you more bitcoin if you deposit some with them first. Some of these are akin to Nigerian prince emails. Other times, famous people on Twitter get hacked and say they will send 2 bitcoin for every one bitcoin you send them. This one time, a company bought ad space on the biggest bitcoin podcast and told everyone they would pay a 7% yield on bitcoin deposits. The most recent heist was pulled off by some vegan pervert who claimed to be an autistic genius and effective altruist. The plain fact is, solving the double spending problem means there is no way to recover your bitcoin if it gets stolen or swindled. You must be vigilant. One whole bitcoin might be worth 10 million dollars in ten years, but if your bitcoin gets stolen or lost, you and your posterity will be unable to spend it.

To protect ourselves, we must:

NEVER GIVE ANYONE YOUR 12 OR 24 WORD SEED PHRASE

REMAIN AS PRIVATE AS POSSIBLE

STAY HUMBLE

Staying humble is not as easy as it sounds, but it is necessary. If you get too over-confident, you might make mistakes. Mistakes can be disastrous. We have all heard stories of people combing through landfills hoping to find laptops worth hundreds of millions of dollars. You don't want to be that guy. The goal of this guide is to teach you how to use bitcoin as it was meant to be used--as peer-to-peer electronic cash.

What Is Bitcoin?

"Writing a description for this thing for general audiences is bloody hard. There's nothing to relate it to."--Satoshi Nakamoto

Bitcoin is a peer-to-peer electronic cash system. This is a simple sentence composed of nine words to describe a new monetary system Satoshi explained in nine pages. It contains a lot of math most people don't understand and that's just the calculus. The white paper doesn't have any cryptography because much of the cryptography behind the bitcoin timechain comes from Adam Back's HashCash. Therefore, bitcoin is difficult to explain to a general audience because it is a synthesis of many different components very few people are familiar with. Understanding the intricacies of bitcoin requires background knowledge in distributed computer networking, public key cryptography, Austrian economics, computer science, game theory, calculus, probability, and the history of money.

Most people receive very little( if any) education about these subjects in public school and only a small percentage of college graduates learn anything about these subjects. This makes the bitcoin white paper a work of art very few people can appreciate. I had no idea what most of the White Paper meant when I first read it because I knew almost nothing about these subjects back then. I never heard of cryptography and failed Algebra II in high school and I never took calculus either. I was obsessed with low-stakes, limit hold 'em before studying bitcoin, but that gave me just enough background knowledge to understand this was a serious project.

Satoshi Nakamoto was a brilliant mathematician. He made me realize math is a language like C++ or English. He often translated the code into math, math into code, and code into plain English. In many ways, the bitcoin white paper is like the Rosetta Stone, but one can argue it's historical significance is greater than the Rosetta Stone. This may sound like a bold statement to the uninitiated, but I consider it to be a work of art. I believe anyone with an average IQ can comprehend the bitcoin white paper given enough time, and I encourage you to read it. Then study bitcion more. Read it again. Rinse and repeat.

For the purpose of this guide, however, we will only focus on a the first few sentences.

*A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital Signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network.

The purpose of this guide is to teach you how to use bitcoin the way it was meant to be used-- without going through a financial institution.

Explain It To Me Like I'm 5

A decade ago, bitcoin was difficult to learn, but now we have cartoons. This guide aims to make bitcoin easily understandable by anyone with a high school education. If you want to know the gist of why bitcoin is important, watch this three minute clip of the first bitcoin cartoon. You don't need need to learn much about math to use bitcoin if you don't want to. You just need the basic idea behind what the math accomplishes. Here is a three minute explanation from the Tuttle Twins.

This Is Not Financial Advice

Bitcoin is math. This guide is written from the perspective of a dad teaching his kids how to use that math to save bitcoin without going through a financial institution. This is education not financial advice. The point of this guide is to teach you how to stack sats. A million sats is a million sats. I can't predict when a million sats will buy $10,000 and even if I could...Who knows what $10,000 will buy. This guide is bitcoin only and is not concerned with measuring this peer-to-peer electronic system to the money printer go brrrrrr fiat system.

There are no guarantees and it is written with no warranty. If you lose your keys, no one can help you spend your bitcoin. As Satoshi said, it becomes a donation to everyone on the network. Therefore it is important for you to remember the following:

NEVER TYPE YOUR KEYS INTO A COMPUTER CONNECTED TO THE INTERNET

NEVER GIVE YOUR KEYS TO SOMEONE ASKING FOR THEM.

NEVER SEND BITCOIN TO SOMEONE WHO CLAIMS HE WILL GIVE YOU MORE BITCOIN IN RETURN

Financial Institutions Are The Double Spending Problem

The bitcoin white paper was released on October 31st, 2008. The software went live on January 3rd, 2009. The day the genesis block was born using an obscure branch of mathematics known as cryptography. Crypto means secret and graph means writing. Therefore, cryptography is a type of secret writing that has existed for thousands of years. Satoshi left a secret message in the scriptsig(hex) of this block. I said is not necessary to learn much about math if you want to use bitcoin, but the math in the first block is one exception. To the uninitiated, this is just a random string of letters and numbers, but it is actually a huge insight into why bitcoin is important and what solving the double-spending problem achieves

scriptsig(hex)

04ffff001d0104455468652054696d65732030332f4a616e2f32303039204368616e63656c6c6f72206f6e206272696e6b206f66207365636f6e64206261696c6f757420666f722062616e6b73

Challenge 1

Decrypt the secret message Satoshi left in the genesis block.

Why do you think Satoshi left this message in the bitcoin genesis block?

₿logging ₿itcoin 841,975

debtclock

🧡 Support this blog by using the Value 4 Value model.

Follow Me on Nostr

⚡[Zap This!(10% Goes To OpenSats)]https://nosl.ink/tadiqmv-)

🍐Join my Keet Room

📻 Stream sats

❓Send a Boostagram

🛒Shop The Elliptic Curve Economy