Privacy Is Necessary For An Open Society In The Electronic Age

"If we are not prepared to defend a tolerant society against the onslaught of the intolerant, then the tolerant will be destroyed, and tolerance with them."

-Karl Popper, The Open Society And Its Enemies

In the last chapter, Satoshi Nakamoto embedded a secret message into the bitcoin genesis block, "Chancellor on the Brink of a second bailout. 15 years earlier, Eric Hughes wrote A Cypherpunk's Manifesto. This document marks the beginning of the Cypherpunk movement and the quest for private e-cash. It is a short essay and I encourage you to read it. It is only 12 paragraphs. You can also listen to Guy Swann read it on Bitcoin Audible.

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world."

This is a strange concept in today's world because we are now in the electronic age. At this point in history, the open society might be all but gone. People often take the attitude, "I am not doing anything wrong, so I have nothing to hide," but that's not the main problem. Doing something wrong might not be the only reason you want to hide. You might want to stop getting ads for things Google hears you say or baby clothes from Facebook because your cousin just had a baby.

What if your identity becomes a reason for suspicion? Yesterday, you were an average law-abiding citizen, Today, you are ordered to report to a nearby horse racing track. You and told your family will stay there until further notice. Your property is confiscated. This is not the conjuring of a paranoid fictitious story, this is what happened to people of Japanese descent after the government of Japan attacked Pearl Harbor. History is full of examples like this. Peaceful countries go to war, they become totalitarian. One day you live in a fun, free open society. The next day, you are put on a no-fly list, sent to Auschwitz, or become an illegal alien because you left a country dealing with hyperinflation. Maybe this will never happen in your country again, but you can bet bitcoin something like this will happen somewhere, sometime, someplace. What if one day you and some man with a gun and uniform tap your shoulder and say, "Papers please?"

What will you tell him?

I'm not doing anything wrong."

Hughes also writes about financial privacy in this essay. Many Cypherpunks have argued financial privacy is even more important than e-mail privacy. Financial privacy is not just about your bank selling your information to advertisers. The surveillance system gives governments and corporations super-villain powers. Centralized payment systems can be weaponized so they will and have been weaponized. Examples of financial weaponization include [Executive order 6102O]9https://en.wikipedia.org/wiki/Executive_Order_6102) [Operation Chokepoint(

Cypherpunks like Hughes were ahead of their time. In A Cypherpunk Manifesto, Hughes writes, "Since we desire privacy, we must ensure that each party to a transaction know only of that which is directly necessary for that transaction. Since any information can be spoken of, we must ensure that we reveal as little as possible. In most cases, personal identity is not salient. When I purchase a magazine at a store and hand cash to the clerk, there is no need to know who I am. When I ask my electronic mail provider to send and receive messages, my provider need not know to whom I am speaking what I am saying, or what others are saying to me; my provider only needs to know how to get the message there and how much I owe them in fees. When my identity is revealed by the underlying mechanism of the transaction, I have no privacy. I cannot here selectively reveal myself."

Youtube:

Since most digital tools such as email and financial transactions are not private, there appears to be a government-corporate partnership between email, and all financial transactions. Many places no longer accept cash. The government is becoming more intrusive. Governments censor Twitter, shut down social media controlled by China, and many places no longer accept cash. Bitcoin is not 100% private, but we can achieve relatively decent privacy even though the government does not want to lose the power of surveillance.

Bitcoin was not created by what disenfranchised normies call "capitalism," the rigged Wall Street system, that allows hedge funds to short assets they don't have but turn off the buy button when the little guy figures out how to beat them at their own game. Traditional finance is a system where the central bank can just print money out of thin air, loan it to the banks, and allow the banks to print more money to pay back the loan. This system is a far cry from the "invisible hand" Adam Smith wrote about in 1776. There is a hand, but it is not invisible. This is not the laissez-faire capitalism that Ayn Rand wrote about in Capitalism, The Unknown Ideal. It's a mixed economy, with parts taken from dead economic systems like capitalism, communism, socialism, and fascism. It is all of these, yet none of these, a Frankenstein like amalgamation of various economic ideologies. The Federal Reserve is modeled after the fifth plank of the Communist Manifesto:

"Centralization of credit in the hands of the state, by means of a national bank with state capital and an exclusive monopoly."

Financial surveillance we are subject to is a fascist wet dream that was technologically infeasible to achieve 80 years ago. In the dystopian novel 1984, Orwell couldn't conceive of a world where people paid for surveillance tools with their own hard-earned, easy money. No, this is not capitalism, fascism, or communism. Governments around the world have created something some French economists are calling Dirigisme, an approach to economic development emphasizing the positive role of state intervention. H/T Natalie Smolenski Bitcoin fixes this.

Centralized Electronic Cash

Bitcoin was not the first attempt at electronic cash. There have been many predecessors. Hashcash is more akin to a digital postage stamp than cash, but the underlying mathematics behind this stamping system is the backbone of the bitcoin time-chain.

Before bitcoin, there was:

[https://www.investopedia.com/terms/d/digicash.asp]

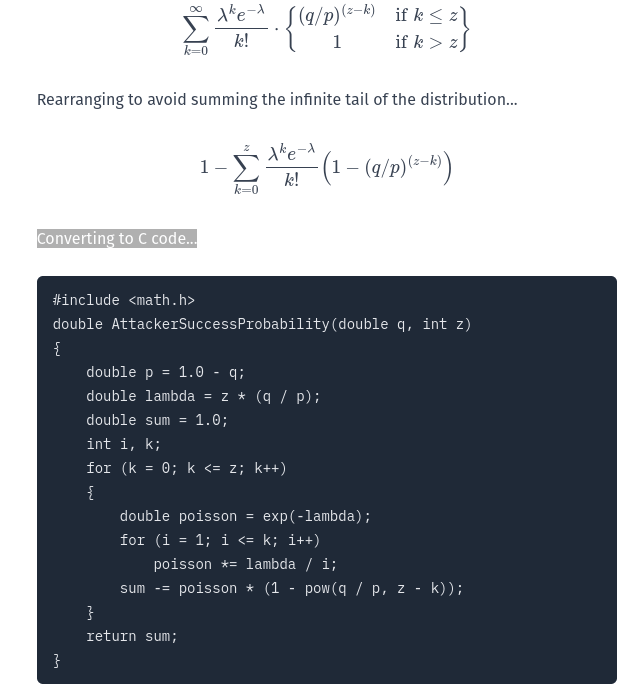

Bitcoin: A Peer-To-Peer Electronic Cash System

The Bitcoin white paper was sent to the Cypherpuink's mailing list on October 31, 2008. It is only nine pages long and has a lot of math. When I first read it, I did not understand much of the math, but I could tell this was a historical document because of its significance. You get the feeling you're reading something like the Rosetta Stone. In the calculations portion of the paper, Satoshi even translates math to c code like the Rosetta Stone translates Greek to Egyptian Hieroglyphics.

Don't worry, you will not need to learn any of this math to use bitcoin. This guide is only concerned with the first few sentences of the Abstract,

"A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network."

Contrary to what much of mainstream media will tell you, bitcoin is not useless. It allows one party to send payments to another party without going through a financial institution. Despite all the financial surveillance, almost nobody saw the Great Financial Crisis coming. Nobody was arrested. You might think Bernie Madoff was arrested, but his Ponzi scheme had nothing to do with the Great Financial Crisis. He probably would have gotten away with it for much longer except people panicked and when they panic they want their money. Nobody noticed Bernie Madoff never had any of their money until the panic set in.

The double spending problem is not one you hear of often, but maybe it is more accurate to describe it as counterfeiting. If I spend a hundred dollar bill for a bicycle, it is a fair transaction because it is only spent once and received the bicycle. Maybe you use the money to buy a scooter, but it's the same money being circulated into the economy. If I print a copy of my hundred-dollar bill, I can buy the bicycle and the scooter. If I print more copies, I never need to spend the original hundred dollar bill and can buy all the two-wheeled vehicles in town. The problem is you can no longer buy the scooter for $100.00 Now you need to buy a scooter that will cost $200 because I reduced the available supply of scooters in the economy and the laws of supply and demand explain the rising prices. Printed money allows privileged people the ability to purchase more property and who has more privilege than the money printers?

If you replace the word bicycle with a single-family home and the counterfeiter with a bank using fractional reserve--You have the same dynamic on a larger scale. The Bitcoin Peer-to-Peer Electronic Cash system is a 100% reserve system. Nobody can create more bitcoin than is pre-programmed to be released. In other words, the bitcoin on the bitcoin system cannot be double spent. If you keep your bitcoin in another system like FTX or an ETF, "the main benefits are lost" because a "trusted third party is still required to prevent double-spending."

It's not that I am afraid of Wall Street changing the rules of bitcoin. I don't believe they will ever make bitcoin increase the supply on the network. I don't even necessarily think they will sell paper Bitcoin. I think they might be able to play games like this for a little while, but will eventually get caught by people watching the network.

₿logging ₿itcoin

847,370

debtclock

🧡 Support this blog by using the Value 4 Value model.

⚡[Zap This!(10% Goes To OpenSats)]https://nosl.ink/tadiqmv-)

🍐Join my Keet Room To Learn About New Blogs With No Email Signup

📻 Stream sats

❓Send a Boostagram

🛒Shop The Elliptic Curve Economy

Also published on my blogL

Recommended Reading: