Dear Louis CK

So if stocks are not safe, banks are crashing, house prices are dropping…I would put all my cash under the floorboards but there’s also inflation. Sooo do we buy Bonds?

— Louis KC (@NotlouisCk) March 13, 2023

PS if you say bitcoin in the comments, I’ll Twitter slap you.

Dear Louis CK,

I don't know much about stocks. I don't really know why unprofitable companies go up in value. I don't know why so many people bought bonds that pay 1.5% when the goal of the Federal Reserve is to keep inflation at 2%. I don't know why these investments are considered safe. I sure as hell don't know why banks only keep a fraction of the money on reserve. I also can't predict what the Federal Reserve will set the interest rates to. I don't know how the USA will pay off the national debt.

I just know we have a peer to peer electronic cash system named bitcoin.

Ducks Twitter Slap by using nostr

We use the lightning network to pay for coffee. Here is a video of Alex Gladstein buying a cup of coffee in El Salvador. Bitcoin is legal tender in that country. Alex works for the Human Rights Foundation.

Flawless experience using @MuunWallet here in El Zonte to buy all sorts of things with Bitcoin 👌

— Alex Gladstein 🌋 ⚡ (@gladstein) September 2, 2021

If you visit, make sure to stop by for a coffee with Karla, an excellent barista.

You can tip her instantly from anywhere in the world with Lightning here:https://t.co/qFWYI0bt4e pic.twitter.com/ruyBLWrRy7

Zaps On Nostr

We use the lightning network to send zaps on nostr. A zap is a bitcoin payment sent over the lightning network. It takes seconds and zaps can be made to anyone with a nostr account and a lightning address, and Internet connection, no matter where they are in the world.

We Tip With Bitcoin

We don't know what the value as compared to dollars will be on any given day. Nor do we know how many dollars exist. We do know how many bitcoin will exist. We also know the last satoshi will be mined somewhere around the year 2139.

Bitcoin is information crypto graphically proven to be true. It does not need FDIC insurance. Math does not lie. People lie. If a $100 bond is worth $80, the central bank says, "No... the price the free market gives this bond is wrong. A bond that pays 1.5% interest in and 8% interest world is worth $100." They lie.

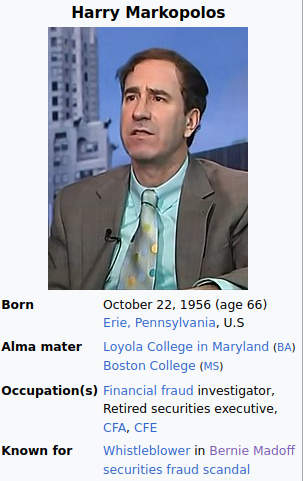

When Bernie Madoff stole billions of dollars and did not invest any of it. His clients did not lose money because of the great financial crisis. His clients panicked like everyone else at the time so demanded their money. He just didn't have it because he already spent it paying Peter after robbing Paul. People lost their life savings because they trusted Bernie, one of the founders of the Nasdaq. Before his Ponzi Scheme collapsed, this guy named, Harry Markopolos noticed Bernie "would have had to buy more options on the Chicago Board Options Exchange than actually existed." He caught onto Bernie's Ponzi Scheme in the late 90's. He did not just trust Bernie Madoff. He verified the Madoff's math, but the numbers did not add up. He tried to tell the SEC. launching an investigation of Madoff's business. The regulators came up empty handed because they were bamboozled by the Nasdaq founder. Essentially, nobody listened to Harry Markopolis, but he was right.

Bitcoin did not exist back then. Bitcoin has a Timechain that audits the entire network every ten minutes on average. We can calculate how much bitcoin has been made in minutes. We don't need to be a math wizard like Harry Markopolos because of this. We don't need to trust SEC regulators. We just run a single command.

bitcoin-cli gettxoutsetinfo

This Is Not Investment Advice

Bitcoin is not an investment. Bitcoin is a peer-to-peer electronic cash system. If you have 100% faith in the US dollar and banking system, congratulations, you don't need any bitcoin. Maybe you have a financial advisor like Bernie Madoff. If you mistrust the fiat US dollar and banking system just 99%, maybe you should put 1% of your assets in bitcoin just in case. If you trust your financial advisor 100%--I guess you will not need any bitcoin either. How valuable is bitcoin? It changes from day to day. Sometimes it drops especially when a lot of people start trusting people like Sam Bankman-Fried to hold their bitcoin and casino coins like people trusted Bernie Madoff to invest their life savings.

If bitcoin goes to zero, yo0u probably won't be able to buy a cup of coffee with it anymore. At least you only lost 1% of your assets. You can probably handle a 1% loss, but if bitcoin fails the banking system better make it. What are we going to do otherwise? Go back to trusting the banks have gold in the vaults? Use salt again? Invest "risk free" like Madoff's clients thought they were doing?

One thing is sure. Bitcoin properly secured in your own wallet does not require trust. It does not require the esteemed qualifications like those of Bernie Madoff. It just requires thousands of nodes verifying the math 144 times per day. We can verify that bitcoin is there even though we do not know how much people will value that mathematical trust of the system in fiat terms. This doesn't matter because when money dies again, bitcoin will be there. Hopefully the world will be ready to use it before then.

Don't Trust, Verify

Blogging Bitcoin

783,671