Don't Trust Verify

Don't Trust, Verify

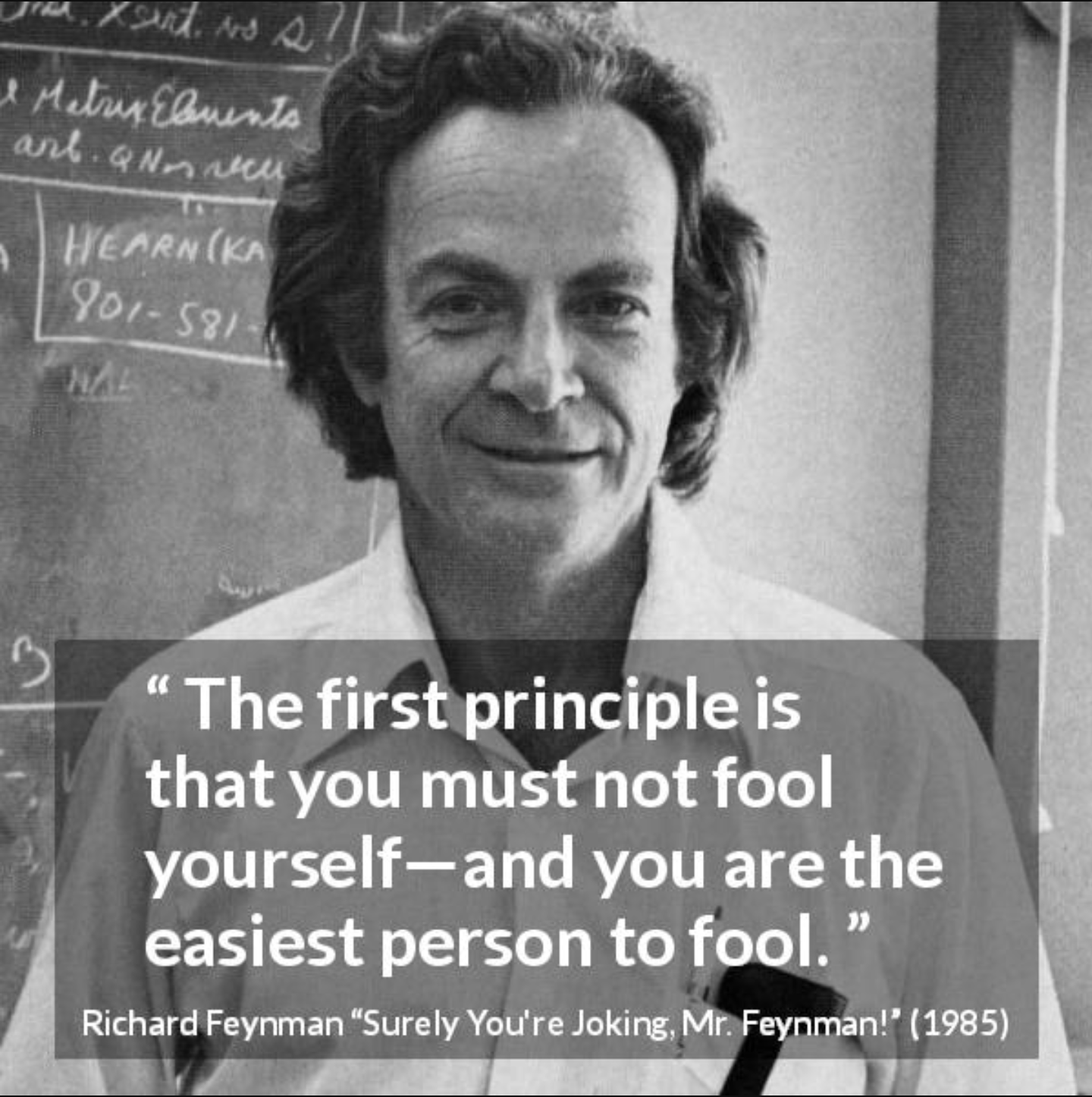

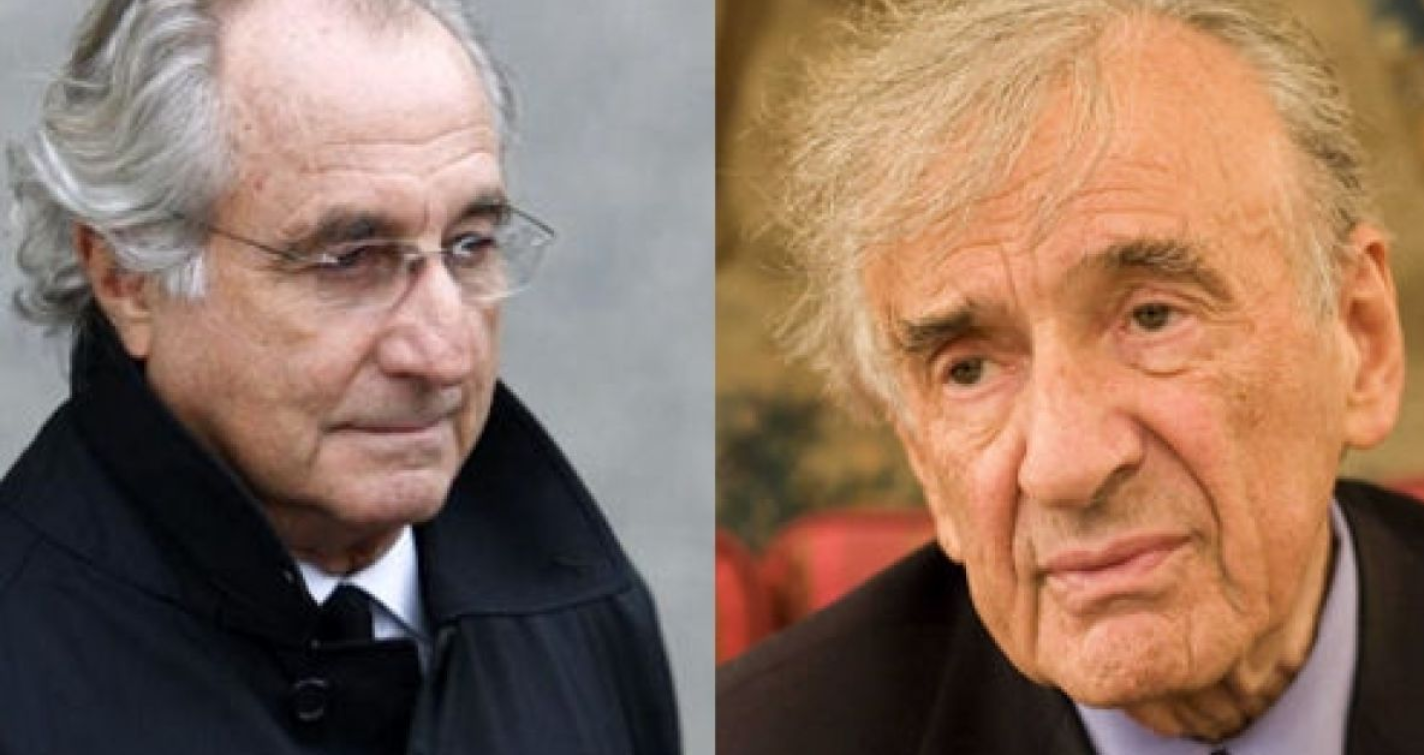

A few months ago, I watched the Madoff documentary on Netflix. According to the documentary Madoff was a respected, founder of the NASDAQ stock exchange, and ran the biggest Ponzi Scheme in history. He also happened to be of Jewish descent.(This is important an important detail to the story, no anti-semitism intended). Because of his ancestory, Madoff befriended prominant rich people within the Jewish community. He leveraged his religion, culture, and esteem to his advantage. Steven Spielberg and Elize Wiezel were among his victims.

Spielburg is one of the most famous directors, but Wiesel was best known for his memoire, Night, a book about his experience at Auschwitz and Buchenwald. He told the story of waving goodbye to his mother and sister as they stood in line for the oven. Oprah interviewed him. Bernie Madoff made promises. He promised to invest his client's money. I would bet his victims spoke highly of capability given his high returns. He was Jewish too. Most people tend to like other people who share the same cultural values as they do. This is not unique to Jewish culture, it's a hypothesis of every culture. Who could understand the investment needs of Jewish people better than someone who observed Chaunaka and understood the struggles Jewish people had to suffer? In other words, some smart people found Bernie Madoff easy to trust because his cultural heritage matched their cultural heritage. There was just one problem. All cultures include a certain percentage of untrustworthy people like a bug in computer software.

Bernie Madoff was a crook and although he did not cause the Great Financial Crisis, he became the poster boy. When things go bad, good people look for a scapegoat. Bernie did not make his money off of these plants but stole some of the money from a Holocaust survivor. I'm not saying drugs are good, but Bernie Madoff deserves a special place in hell.

He didn't have anything to do with the collapse of Lehman Brothers though. He didn't cause the bank runs. He didn't buy or sell Mortgage-backed securities and derivitives. Almost nobody went to prison for the great financial crisis. Most people involved got a bailout of almost one trillion dollars. Bernie, founder of the GOAT Ponzi died in prison.

The Anatomy of A Ponzi

The word Ponzi comes from the con-man, Charles Ponzi who is credited with inventing the scheme. It works like this. The scammer tells Paul, "I've been getting 21% returns in the stock market. Do you want in on this?"

Paul thinks..."That sounds too good to be true, but I know Charles. He's a good guy. He also belongs to the Church of the Flying Spaghetti Monster just like me! 👍"

”Sure. Here's $100,000. TO THE MOONBEAM!"

Charles takes the $100,000. That's it. He doesn't invest it.

"Yo Peter! I got this hot investment tip. I've made 21% for 5 years. It uses 'blockchain technology.’ You know what that means?

"TO THE MOONBEAM! Here's a check for $200,000,” Peter says.

Charles doesn't invest Peter's money either.

He calls Paul instead. "You're not gonna believe this. Video games on a blockchain already went to the moonbeam. I can give you $125,000 or you can let it ride."

"Doood...That's awesome. I'll take my chips off the table," Peter says.

Charles pays Peter $125,000. He made $75,000 off this scam. What if Peter wants his money back? No problem. Mary just called. "Hey! I ran into Paul at the Church of the Flying Spaghetti Monster. He tells me you made his money Moonbeam. I have $400,000, my life's savings. Can you make it moonbeam?"

"Of course. TO THE MOONBEAM!"

Video games on a blockchain are an obvious scam-coin Ponzi scheme. Ponzi schemes come in many shapes and sizes, but you've heard this story before --Robbing Peter to pay Paul. Ponzi schemes are yet another way to describe something we've been over before -The double spending problem. That's all a Ponzi scheme is. Peter gives Charles money. He spends this money on Paul and keeps some for himself. Meanwhile, Peter thinks Charles did not spend his money and still believes that money is still there for him to spend in the future. We have an idiom in the United States. "You can't have your cake and eat it too." If you eat the cake, it ceases to exist. Therefore, you no longer have it once it is eaten. Paul gave Charles his piece of cake with the expectation of eating 1.21 cakes in the future. Charles already ate Paul's cake though, so he had to give Paul Peter's cake.

The same is true of money. You can't have your money and spend it too. You also can't have your money if Charles spends your money unless Charles robs Peter to pay Paul. Then, Peter can't have his money unless Charles also robs Mary. When there's no money left to rob the entire system falls apart.

Fractional Reserve Banking Is A Ponzi Scheme And Bitcoin Fixes This

"A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution."

-- Satoshi Nakamoto, Bitcoin: A Peer To Peer Electronic Cash System

"I've developed a new open-source P2P e-cash system called Bitcoin. It's completely decentralized, with no central server or trusted parties, because everything is based on crypto proof instead of trust. Give it a try, or take a look at the screenshots and design paper...

The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, and trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible."

- Satoshi Nakamoto. February 11, 2009

"Hey, Paul. Are you interested in a blockchain? Look at my charts. To the moo..

"Nah, man. I got this new thing. Here's how it works. First, I write down 12 words. Then, I tell you to go fuck yourself."

Now Paul holds his own keys. His money becomes valuable by doing nothing. Nobody can guarantee this, but those who accept the quantity theory of money expect bitcoin to get this as long as more people adopt it. Almost every other asset on the planet requires permission to own and must be held by a trusted third party. Your stocks can be confiscated. Most people need permission from a bank to buy a home. They don't print money for everyone. Many people may never qualify for a mortgage, but the value of their savings will degrade faster than house paint. We will learn later that all other cryptocurrencies suffer this same fate.

This money goes down because the government is incentivized to print money, but they can't print steer. Therefore, more dollars chase more ground beef. Ground beef, as well as everything else, goes up in price when compared to dollars. This is why Dollar Tree no longer sells anything for less than $1.25 and many items cost much more. This is also why so many people young people saving in dollars will find it so difficult to buy a mortgage now.

Paul saved fiat to put a down payment on a house for five years. Then the pandemic happened. Peter stayed home. Paul stayed home. The government gives Paul $1,200 and a cushy unemployment check. They also cut a $1,200 check to Peter plus an additional $80,000 "loan." When the loan is forgiven, Peter buys a second home and rents it for 40% more than he could have got before the pandemic because the house is worth 40% more. When Paul begins working again. He had $20,000 saved for a down payment, but can no longer compete with $80,000 down payment Peter has. He is priced out of the market and has student loans to pay.

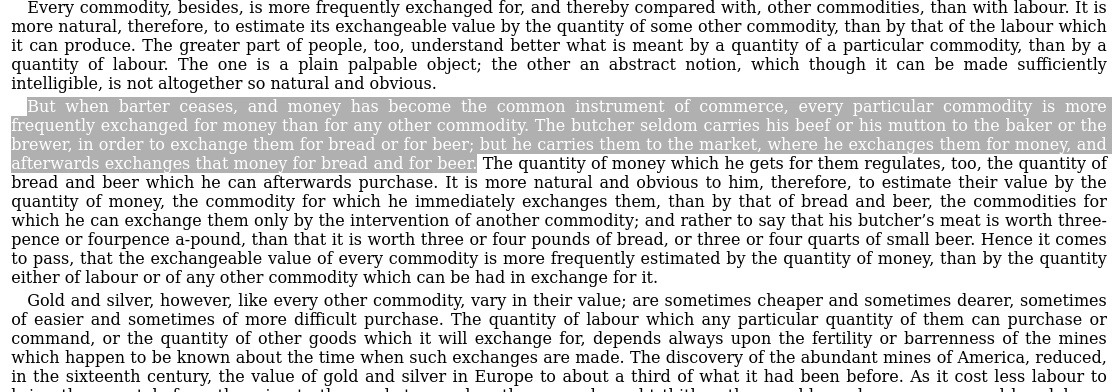

People blame capitalism, but this is not capitalism. This is the Cantillon effect under a socialist monetary system. Adam Smith wrote about capitalism in 1776 in The Wealth of Nations. He described it as an invisible hand. The baker, the brewer, and the butcher all work to make life better for themselves. The baker sells his bread to the butcher, the brewer sells beer to the baker and they all prosper based on their proof of work. The free market is the invisible hand. The modern financial system is something else, not capitalism as Adam Smith described. There is no more "invisible hand." There is a hand that picks winners and losers and everyone can see it like a trick a bad magician attempts.

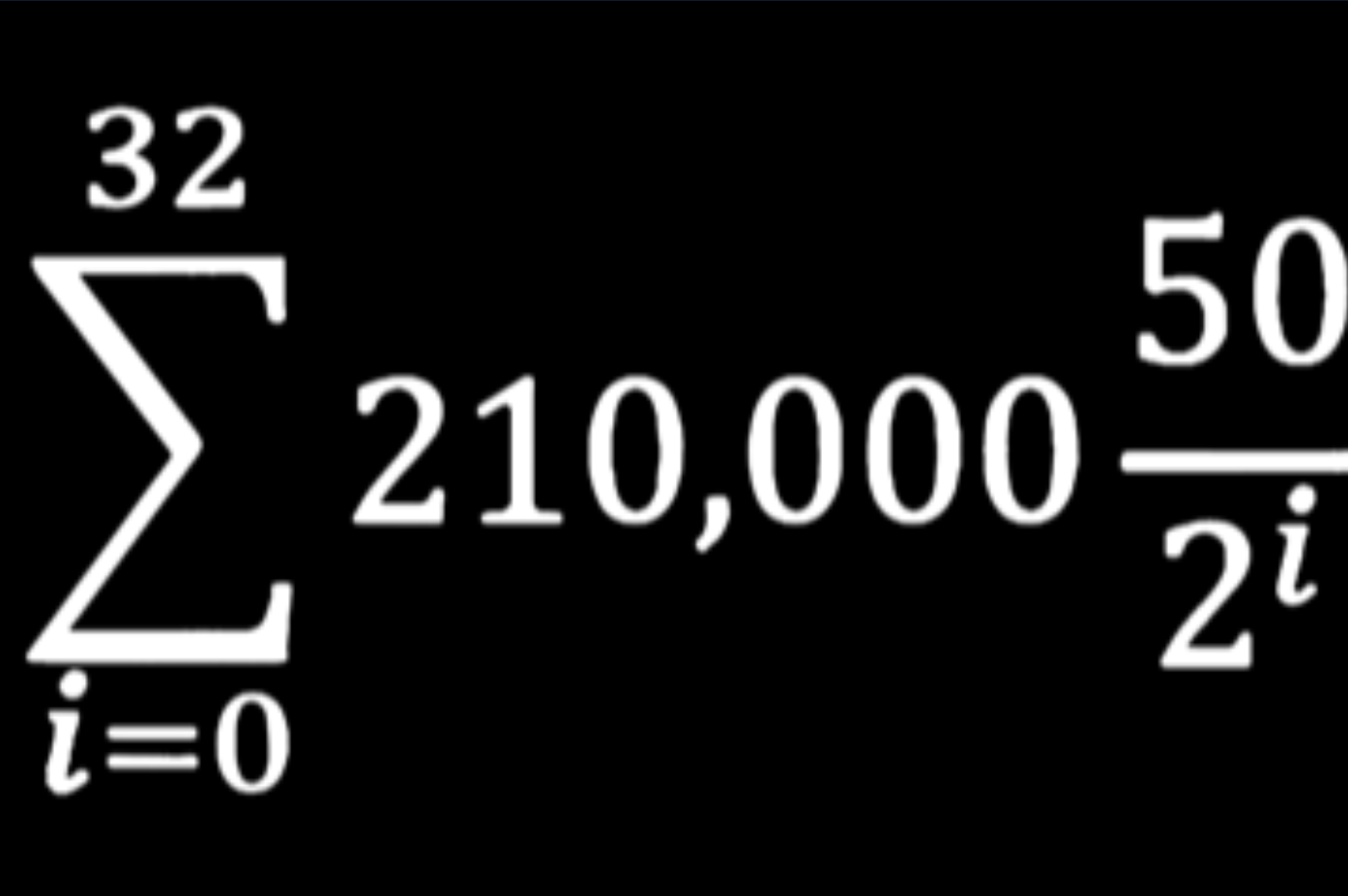

The point is, that you cannot trust the government. You can verify every sat you own with a $400 computer and about ten minutes of competition. You cannot verify the amount of Social Security you will receive or what age they will give it to you. (if at all) Say you make $40,000 a year. This means about $100 of your paycheck goes to social security. If the government put bought bitcoin with that money for nine years, you would have $1,656,380 for your retirement at the time of this writing.

If you retire at 65 and expect to live to 100, you could spend 47,325.14 every year for the rest of your life. Of course, this assumes bitcoin ceases to go up in price. That is capatalism. That is capital. Social Security is socialism. What other context do you think the word "social" means?

Bitcoin is real capitalism. The economic regimes of the world are not capitalism. They are a Frankenstien-esque amalgomation of socialism, capatalism, communism, and fachism. Natalie Smolenski says this new economic system is being called a controlled economy by modern French economists. This is the best definition I've heard, dirigisme h/t Natalie Smolenski

Bitcoin Is Hope

That's why Bitcoin is hope. This is not the glittering generality you might see on a presidential campaign poster. My mom remembers buying mayonnaise for a nickel. In End The Fed, Ron Paul says he "learned the value of a penny," as a kid. A few weeks ago, while in my office, my 14-year-old son screamed, "Dad! Get down here!”

I thought he was bleeding. "Wh...Wha..What happened?!!!"

”These cheese and pretzels used to have 6 pretzels and now they have 5! IT'S SHRINKFLATION!"

Before the pandemic, 6 pretzels and a gob of cheese product cost $1.00. Now 5 pretzels and a smaller gob of cheese product cost $1.99. When teenagers notice inflation like your grandparents, there's a problem. Another way to put it is there is a double spending problem. Do you see it?

That is the hope of Bitcoin. We hope the technology that solved the double spending problem fixes this. If it does, Peter can hold his own money. He doesn't need to keep it in a savings account that pays 0.01% interest. He doesn't need to hand it over to an investment banker, a corporation that buys all the houses, a government that promises to take care of you in your old age, or the next Bernie Madoff.

He just needs to hold Bitcoin himself. Bitcoin will do what it is programmed to do. He runs a node. He stamps steel. He learns how to use passphrases and multi-signature. He stacks sats.

What If Bitcoin Is The MySpace of Money?

I never heard FTX until about 2016 blocks before the collapse. I heard SBF paid politicians like a Wiseguy, paid for commercials with Tom Brady on the Superbowl, and gambled customer bitcoin away. Bitcoin had an immaculate conception. It wasn't worth anything for two years.

I haven't watched the Super Bowl in over a decade. I don't know why people scream when someone scores a touchdown. I know American Football players are notoriously bad with money. I have no idea why anybody would take investment advice from someone who spends as much time learning about football as I have spent learning about Bitcoin.

I suspect it's an old-fashioned affinity scam. Tom Brady plays for "my team," whatever that means. He's a winner and I want to be on team winner. He's betting on FTX so I'm betting on FTX. People trust Tom Brady like they trusted Bernie Madoff. Humans are hard-wired to trust people who have a lot of money, claim to believe the same religious stories or wear a nice suit. We have a motto to protect us from this tendency.

Don't trust, verify.

Ronald Regan is credited with saying, "Trust, but verify," but I haven't actually verified this quote. Nevertheless, bitcoiners modified this quote to reflect the fact that Bitcoin is math and can be verified the same way a high school freshman verifies algebra. It's all math on a computer network. Therefore, if you run your own full node, you can verify you retain control of every sat you owe.

The centralized fiat debt system has:

- Bank bailouts

- National debt

- Unfunded liabilities

- The Cost of the top 150 items Americans Spend Money On

- Multi-trillion budgets

- Stimulus checks

- PPP loan forgiveness

- Soverign wealth confiscation

There Is No Next Bitcoin

]

]

--Knut Svanholm. Independence Reimagined.

This book is titled after the first sentence of the the bitcoin white paper. Now it's time to peruse the second sentence. "Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending." Digital signatures are cryptography. Cryptography is math. Cryptography is useful. You might find a few uses for a couple of shitcoins, but value is subjective and not determined by utility. Nostr is an example of a digital signature. It uses the same cryptography bitcoin uses to sign transactions to sing notes... and other stuff. In other words, signing a nostr note and signing a bitcoin transaction share one attribute: The same type of digital signature.

As a matter of fact, a Bitcoin key is not much different from a nostr key. When we posted a note on nostr, we were digitally signing that note with our private key and broadcasting it. We will also do this with bitcoin transactions, but that's where the similarity ends. According to Satoshi, digital signatures are not the only thing required for a peer-to-peer electronic cash system. They are only part of the solution.

Digital signatures have utility. They are great for PGP, holepunch, bittorrent, nostr, and secure websites. I hate to admit it, but even banks use cryptography. The three digits on the back of your credit. card are also a private key, but the problem is, you need to give this private key to every merchant. Cryptography is useful. The cypherpunks thought it could be used to achieve freedom. I tend to agree.

Although cryptography has utility, this does not mean there will ever be the "next bitcoin." Don't fall into the trap, like so many shotcoiners, of thinking Bitcoin is the MySpace of crypto. Bitcoin is a protocol. It is the https:// of

Bitcoin is the only viable alternative to central banking. There is no bitcoin alternative. There is no "next bitcoin." As Knut Svanholm says, it's our one shot. There are some digital signatures that are useful, but there is no way to re-discover absolute mathematical scarcity. Monero is not absolute digital scarcity. Neither is Ethereum, but it is also not decentralized. It's more like a Central Bank that uses digital signatures to earn fees on Ponzi schemes. Stablecoins might be a better shitcoin than the shitcoins of some shithole nations, but it's still a shitcoin. None of the other coins or tokens are a viable alternative to central banks and Ponzi schemes. But...what about Shibu Inu, NFTs, dogecoin or...? Don't be a fucking dolt. Anyone who says you should invest in or save any cryptocurrency other than bitcoin is either confused or lying.

A made a chart that describes my strategy because I know so many people like looking at charts, and doing technical analysis. Therefore, I decided to make my own chart. I call it the fuck fiat model. Look at the chart and compare it to more popular models like the stock-to-flow model. It's a simple chart. I used PSI and bowling ball bands to come up with this chart. Oh...and of course, this is not financial advice.

According to Jack Mallers, all but two of the top ten coins on coinmarketcap are proof-of stake. Proof of stake is just a complicated way nerds re-imagine central banks. Proof of work tethers a currency to the reality of physics. In reality, you cannot have your cake and eat it too, but in fiat philosophy we can eat more cake than we can bake. Fiat has not been tethered to reality since 1971. Then this happened. Proof of stake is just another currency by decree. Dogecoin also uses proof-of-work, but it's dumb because the supply schedule was changed. Bitcoin is the only game in town where the rules cannot be changed by decree. Therefore, bitcoin is the only non-fiat currency. Some may argue precious metal like gold and silver are another exception, but it's a moot point, because it still requires the government to follow the rules. The rules of the US constitution are difficult to change on paper. There was no constitutional amendment to change these words:

"No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts;"

The government changed the rules anyway

Most people in the world today care more about the fiat they can put in their Financial Institutions than they care about purely peer-to-peer electronic cash systems. I would bet most people still think the US dollar is "backed by gold," so it must be tied to reality. That's what it says in the constitution. Why would they believe otherwise? Some companies take advantage of this tendency by giving fiat loans to people to give them control of their bitcoin. Some of these are legitimate businesses, but you should avoid lending your bitcoin unless you know how to assess risk.

Every bitcoin loan involves risk of loss. You can mitigate this risk by never loaning your bitcoin. Bitcoin has no interest. It goes upon value relative to dollars that go up in circulation. They print more and more fiat. Bitcoin prints less and less sats. There isbno such thing as a bitcoin savings account.

If you must take a loan, demand to hold one of three keys in a multi-signature quorum. Don't risk more than you are willing to lose. If you lose your job and can no longer make payments, you will still lose your sats. If bitcoin flash crashes 50%, you can kiss those sats goodbye. Bitcoin collateralized loans avoid rehypothecation risk, but not risk of loss from a crash or missed payments.

BlockFi bought ad space on the most popular bitcoin podcasts. Many "influencers" were paid to tell people to sedn their sats to blockFi. It always seemed strange to me that peopel who say "not your keys, not your coin" also say you should send your sats to people wearing suits. Blockfi rehypothicated. There is no other way to obtain earn more bitcoin without mining. They traded customer bitcoin to make more fiat to buy more bitcoin. The trouble is, they lost the Bitcoin. The same thing happened with SBF. So many people were fooled by the promise of more bitcoin. They forgot about the first few sentences of the bitcoin white paper.

”A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network.”

-Bitcoin white paper

Bitcoin solves the double spending problem. Russia thought the money it kept in a Belgian bank would be there for Russia to spend. Russia thought this money would be spent by Russia in the future. This money was spent on the Ukraine instead. Your opinion of Russia or Ukraine does not change this fact. Fuck Russia and the Ukraine, but it is easier to achieve peace when everyone plays by a set of rules that cannot be changed without the agreement of everyone involved. That's what makes bitcoin such an important discovery. Bitcoin is not a way to make more fiat. Bitcoin is anti-fiat.

I highly encourage you to watch Jack Mallers speech about alt-coins.

₿logging ₿itcoin

849,850

debtclock

🧡 Support this blog by using the ⚡Value 4 Value model⚡

📧Subscribe on Substack

🍐Join my Keet Room If You Prefer To Learn About New Blogs With No Email Signup

💵Fiat-To-Sats Calculator

🫙 Tip Jar

📻 Stream sats on Fountain

🎉Send a Boostagram

🛒Shop The Elliptic Curve Economy