Bitcoin ETF’s Should Observe The Proof Of Keys Holiday

Bitcoin ETF’s Should Observe The Proof Of Keys Holiday

Every New Year’s eve, I stay up past midnight, drink non-alcoholic beer, pop poppers, and throw little pebbles wrapped in rough toilet paper that explode on impact. Such is my family tradition. T

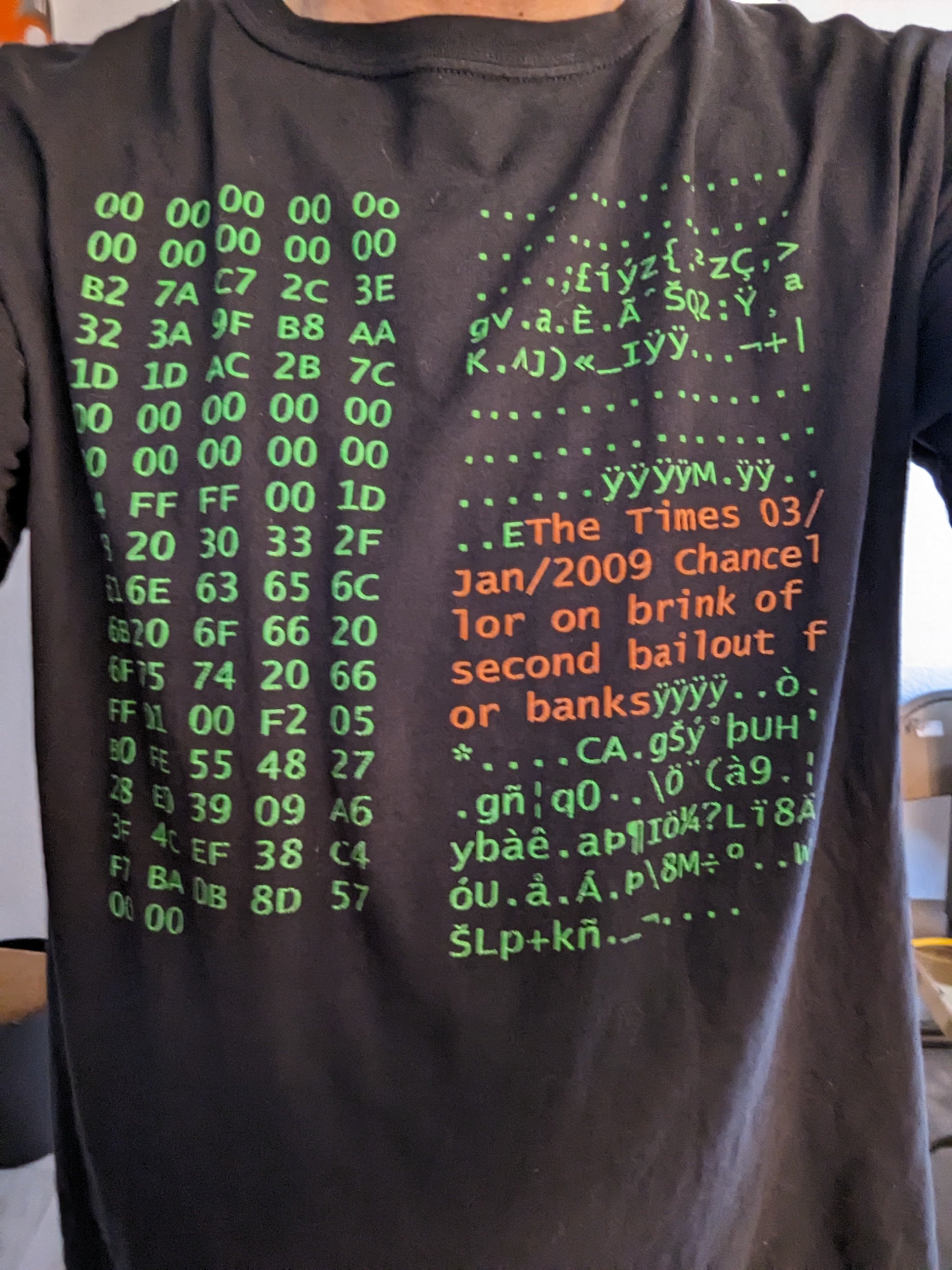

Although I love new years day, January 3rd is my favorite holiday. It’s a time I like to spend thinking about the contents of the message embedded into the genesis block. It’s a day where I where this t-shirt

This will be my tenth year in bitcoin. The main reason I was interested in it back then was because I did not think fractional reserve banking was fair. It makes the rich richer and the poor poorer. You need permission to hold on to your value in the current system. You can’t get 100x returns unless you are already an accredited investor with at least a million dollars in net worth. You can’t buy a house if you don’t make the right amount of income. If you have a low income like I did ten years ago, you might only be able to scrape up $20.00 a month to save. If you put it in a savings account, you’ll have $20.20 at the end of the year. You’ll need to pay taxes on your 20 cents of capital gains. There are creative ways of saving more if you are willing to live in a van or eat nothing but lentil soup, but these days it’s getting more and more difficult for professionals to hold on to spending power and qualify for a mortgage without moving into a van.

When I heard Andreas Antonopolis tell Joe Rogan the secret message embedded in the genesis block, it was as if he was saying Hey Blogging Bitcoin. I’m talking to you. Look into this bitcoin thing because it is a solution to a problem you’ve been irked by for over a decade.” Weird how my mom named me Blogging Bitcoin , right?

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

Back then, I could listen to every podcast ever created with bitcoin as the subject matter. There were two or three Joe Rogan podcasts, a couple of EconTalk episodes, an an episode about Occupy Wall Street on Ari Shafir’s Skeptic Tank. In this episode, the protester guests said they were protesting the banks and saw bitcoin as a viable alternative to these fuckers who gambled people’s houses away and got bailed out by the government.-- The type of people Elizabeth Warren used to fight before becoming big banks bill-shiller. The episode must sound like a crazy conspiracy theory to normies, but if you read the secret message embedded into the genesis block, how can you come to any other conclusion?

Proof of Keys

Proof of keys is another tradition for me like popping poppers on New Year’s day. The phrase comes from Trace Mayer. The idea is to have everyone take their bitcoin off the exchanges on the anniversary of the genesis block. If everyone did this any paper bitcoin would be wiped out every year. We could prove if the bitcoin exchanges hold on our behalf is really in our account, or if it was gambled away by some diabolical dork-mastermind.

A friend of mine recently told me she met Sam Bankman Fried at a meetup. She told me FTX was an acronym for Full Tilt Exchange. It’s almost as if Fried knew he ran a casino. He paid off politicians to run this casino like an autistic gangsta. It looks like he even named it after an online poker room that infamously turned into a Ponzi Scheme, Full Tilt Poker. I can’t prove this, but both Full Tilt Poker and Full Tilt eXchange turned out to be Ponzi Schemes. Both of them hid their actions behind a thin veil of regulation. Full Tilt was licensed by some official sounding Internet Gaming Commission. Full Tilt eXchange was regulated by some ABC government agency. These regulations purportedly protect consumers. Do they? I don’t need to write a ten page essay arguing for this. You just need to watch the nightly news on NBC to find out. I went on Twitter to shill my local bitcoin meetup and saw a slew of sat stackers singing glory hallelujah because they believe the BTC ETF will be approved by the regulators!

Oh YEAH! Govern me harder. make my number go up until my toes curl. Approve me right there Uncle Sam!

Some Random Dude on nostr argued Bitcoiner’s arguing against an ETF are full of cope. They thought they had more time to stack. This is a straw man argument. Do I wish I had more bitcoin, sure—who doesn’t? If Saylor doesn’t have enough bitcoin, do you think some pleb writing a blog for about 30K sats a month does? That’s not the point. Weaher or not, I have enough bitcoin is not the problem with ETF’s. If it makes the price $10,000,000, I won’t complain. I’ll even sell a little on Strike and pay off my house. I’ll pay the taxes too. It is not that I am against NGU. I am against trusted third parties. I might trust Strike to hold my fiat until I can pay my mortgage off for a little while, but I wouldn’t trust Strike with my entire stack for any meaningful length of time even though I like Jack Mallers and think his company is on the up and up. This is the point:

I understand there is not enough block space or time in the universe for 8 billion people to own a Unspent Transaction Output. I get that, but the solution to that problem can’t be giving up the ability for people to protect themselves from trusted third party fuckery(double-spending).

Bitcoin ETF’s exist outside the US. I think Canada has one. How does the Canadian ETF treat proof of keys day? How does Grayscale prove they are not pulling a full tilt move? How will Blackrock prove they have the keys to the bitcoin they say they have? These are genuine questions I have and don’t have answers to. I can balance a checkbook, but I don’t know how fiat accounting works.

I’m an expert by no means, but I do have a basic understanding about how accounting on LNBits, Liquid, or Fedimints work. I’m not happy with some of the things I hear about Blackrock(Rumers has it, they are gobbling up the American real estate market). That’s probably good for the equity in my house, but I think it’s bad for millions of people who struggle to obtain permission to buy a home. If the ETF makes bitcoin NGU as much as the ETF maxis say it will, I can pay off my house, quit my job and write every day even on 30k sats a month. That would be awesome, but how will the ETF Maxis participate in proof-of-keys day?

How To Regulate an ETF

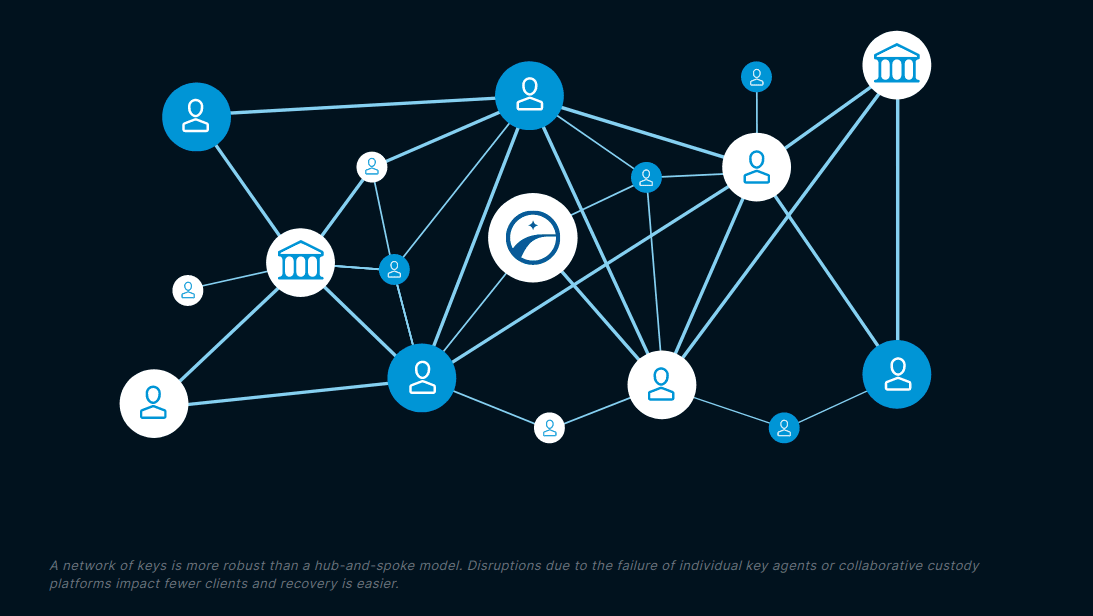

The amount of bitcoin you have or what you do in bed with regulators is none of my business, but I hope those who do want to be in bed with the regulators practice safer exchanging. A better ETF would not be raw animal regulation. It would be more like soft porn. Again, not everyone with a Blackrock etf can receive a key in the mail with a UTXO for many reasons I won’t get into. What if you had a Liquid MultiSig Wallet with a UTXO holding Liquid BTC. We can call this a Liquid BTC Exchange Traded Unspent Transaction Output. The hardest of the hardcore maxis would find this trade-off unacceptable, but I think it addresses the main issue I have with ETF’s. Namely, the trust is no longer reliant on a single trusted third party, but a federation of a third fourth, and 40th trusted third party. You would also be able to log in to your normie Blackrock User Interface and see your liquid Xpub that shows your balance is where black rock says it is. You can verify this on Blockstream's website. Technical users can even run their own liquid node. This would be a safer way to practice ETF. A Fedimint could also work like this and the tech would make it easy to withdraw, but I don’t think a trusted third party like Blackrock is interested in giving it’s clients this power. That’s okay. They are free to make ETF rules however they like. It’s not something I can prove on proof of keys day anyway. Unchained has a great article about using a [network of keys(

From Bitcoin Needs A Network of Keys

Imagine if:

- Blackrock holds one keys.

- Fidellity holds another key.

- Grayscale holds another key

- ...you get the idea.

Say Blackrock has 40 bitcoin, Fidelity has 35, and Vanguard has 25 bitcoin in a collaborative multisig wallet. These are small numbers, but it makes it easier to explain the concept. The regulators approve each one of their ETF’s. If Blackrock sells 41 bitcoin in their ETF, Fidelity and Grayscale raise a red flag. This is possible because of the transparency multi-sig on the bitcoin network enables.

Accountants will still need to do their accounting magic, but something like this will make it easier for accountants to audit the supply, They can do it every year on January 3rd. I got into bitcoin at a time when it was popular to say not your keys not your bitcoin, so I can’t see myself using a BTC ETF, but I am not opposed to an ETF using the minimal structure required to prove the aggregate bitcoin in an Bitcoin Exchange Traded Fund using gettxoutsetinfo. I would even recommend an ETF structured like this to my friends and family.

Again, I am not against an ETF. I just want a BTC ETF to be structured more like a federation or multisig wallet than a gold ETF. After studying bitcoin for about a decade, I believe common sense regulations like this can go a long way in protecting retail and corporate investors. It also allows them to celebrate Proof-of-Keys day, a holiday which is very important to the people in the bitcoin community.Many argue about the semantics of this statement, but we have our own customs and traditions like any other group of people. January 3rd is like our new year's day, but we have other holidays as well such as:

- Bitcoin Pizza Day

- The Halvening happens every 4 years or 210,000 ten minute blocks for the orthodox nerds our there

- The day some drunk guy misspelled the word HOLD.

We Bitcoiners use often recite another meme, "bitcoin is for enemies". I wouldn’t go so far to say Blackrock is my enemy, but I want them to respect the traditions of my culture , not because I am some religious nut, but because I want to prevent them from accidentally becoming someone’s enemy. Most people don’t set out to create a Ponzi scheme. I don’t think Full Tilt Poker, Mt. Gox, or FTX set out to start a Ponzi. It just happened because trusted third parties are security holes.

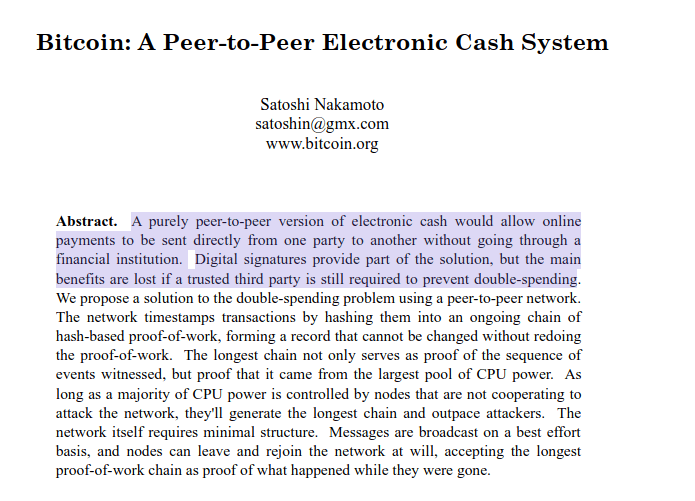

We have the tools to create a BTC ETF that does not rely on a single trusted third party. Any BTC ETF worth buying would use these tools. If not, then what’s the point of the white paper? What is so innovative about a single trusted third party holding a lot of people’s money? It’s just a gold ETF by another name. We already have a gold ETF(I bet we have more than one). We need one BTC ETF with multiple trusted parties

This ETF would allow investors to be reasonably sure there money is in the bank. That is the real innovation of bitcoin. If the digital dollar could do that, businesses would not ever be suffer credit card charge-backs. I would like to see an innovative BTC ETF approval.

I do not want a gold 2.0 ETF. Gold has no multi-signature capabilities. It must rely on a trusted third party or be buried in your back yard. Bitcoin is different and we should treat it as such. This is better for investors and has the added benefit of letting the IRS know exactly how much each BTC ETF owner owes in taxes. I believe a BTC ETF can give millions of Americans a bright orange future if it is done right. Please urge your local regulators to regulate the BTC ETF in a way that makes it safer for retail investors by approving a BTC ETF which does not rely on a single trusted third party.

Happy Proof of Keys day.

฿logging฿itcoin

0 + 824,201 confirmations

US Debt Clock

Support by:

🧡 zapping

🧡 shopping

🧡 highlighting

🧡Sharing this blog on survielence social media platforms

This blog is sponsor free, but I created some v4v ads to promote the use of bitcoin as a payment solution. These are word of mouth ads designed to promote the bitcoin circular economy. These companies do not pay me to shill their products. They are companies I have spent sats with and recomend you shop the circular economy to promote the use of bitcoin as peer-2-peer electronic cash.